south carolina inheritance tax rate

A variety of indigenous cultures arose in the region including some that built great earthwork mounds more than 2000. At the end of the last Ice Age Native Americans or Paleo-Indians appeared in what today is the Southern United States.

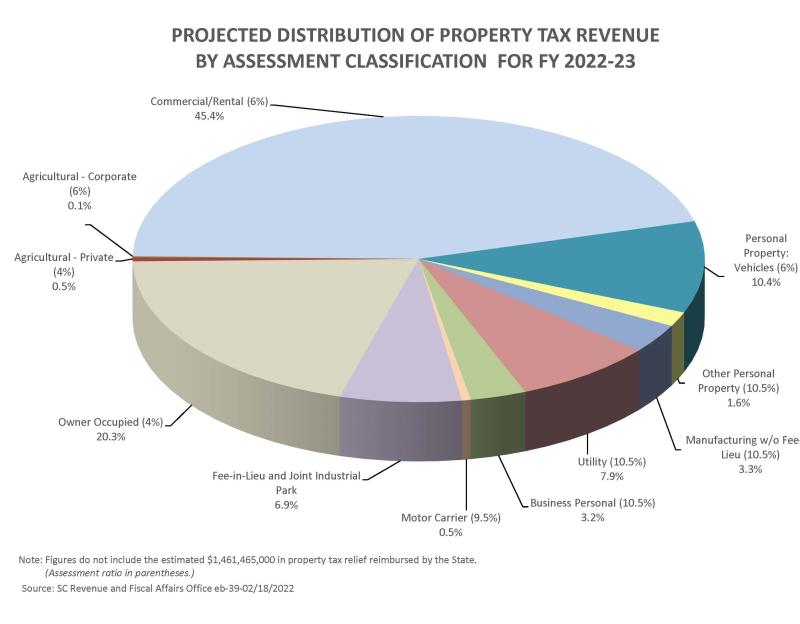

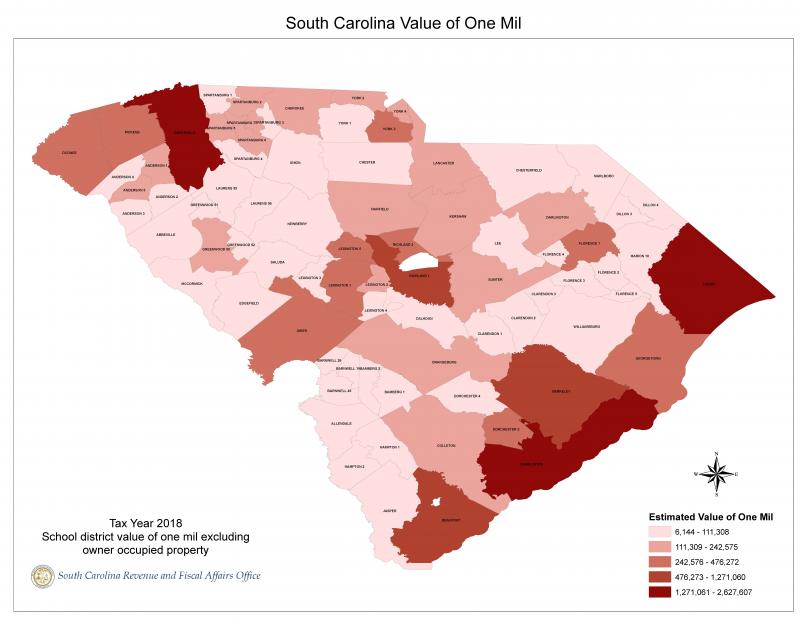

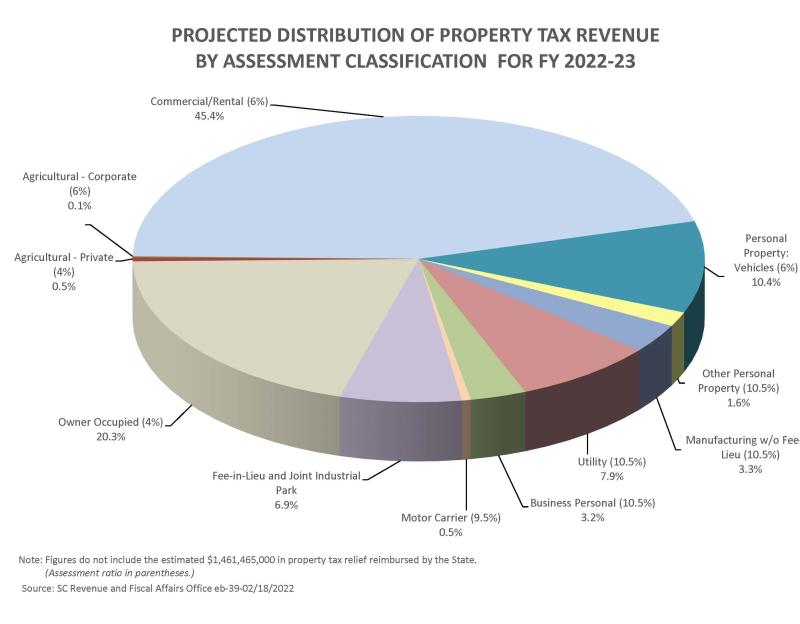

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

South Carolina has a higher tax rate along with slightly higher exemptions.

. Sales tax in North Carolina is 125 lower compared to South Carolina. South Carolina protects the marital rights and benefits of couples who entered into a common-law marriage in a state where such a union is legal. Effect of Amendment The 2013 amendment substituted means for shall mean.

Estate is more than 1206 million in 2022. The statewide sales tax rate in South Carolina is 6. Its possible that you may be pushed into a higher tax bracket depending on how much you receive from an inherited 401k.

Impose estate taxes and six impose inheritance taxes. However local taxes can reduce the difference. Paleo-Indians in the South were hunter-gatherers who pursued the megafauna that became extinct following the end of the Pleistocene age.

Census Bureau population estimates from April 2010 to July 2019 -- note this is well before the pandemic -- show. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional state estate tax or state inheritance taxTwelve states and the District of Columbia impose estate taxes and six impose state inheritance taxes. A tax freeze and municipal property tax reduction are available for seniors age 65 and older and disabled persons.

The assets in the account would be taxed at your ordinary income tax rate not the tax rate of the original account owner. The nationwide average effective state and local tax rate is 114 percent for the lowest-income 20. The average effective property tax rate in South Dakota is 132.

The lower ones income the higher ones overall effective state and local tax rate. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Residents must meet.

South Carolina has no inheritance tax or estate tax. In this detailed guide of South Carolina inheritance laws we break down intestate succession probate taxes what makes a will valid and more. The beneficiary that inherits 401k assets is responsible for paying 401k inheritance tax.

Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. The region straddling the. State levy is 485 but mandatory 1 local sales tax and 025 county option sales tax are added to the state tax for a 61.

That tax rate can be as high as 40. However you are only taxed on the overage not the entire estate. South Carolinas taxation of retirement income is more favorable.

Inheritance and Estate Tax and Inheritance and. This article may be cited as the South Carolina Trust Code. On average the lowest-income 20 percent of taxpayers face a state and local tax rate more than 50 percent higher than the top 1 percent of households.

North Carolina has a higher property tax as a percentage of home value. 100 Section 2 eff January 1 2014. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

Twelve states and Washington DC. Maryland is the only state to impose both a state estate tax rate and a state inheritance tax rate. In this article unless the context clearly indicates otherwise Code means the South Carolina Trust Code.

For further information visit the South Carolina Department of Revenue site or 800. Maryland is the only state to impose both. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498.

The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Common-law partners may be able to assert many of the same rights as married couples including property distribution rights in the event of death or divorce.

To file any of these estate-based returns you. Some counties may charge an additional 1 if voters have approved a supplemental tax. Your average tax rate is 1198 and your marginal tax.

Real Estate Tax Deductions Infographic The Agencylogic Blog Tax Day Estate Tax Real Estate Infographic

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

Ultimate Guide To Understanding South Carolina Property Taxes

Lancaster County South Carolina They Had Named Their County For The House Of Lancaster Which South Carolina Vacation North Carolina Vacations South Carolina

3 Charts That Shout List Your Home Today Real Estate Real Estate Buyers Selling Your House

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

A Guide To South Carolina Inheritance Laws

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Small Towns Usa West Virginia

Free 9 Sample Income Verification Forms In Ms Word Pdf

State By State Guide To Taxes On Retirees Kiplinger

Real Estate Property Tax Data Charleston County Economic Development

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

What Is Private Mortgage Insurance Pmi Private Mortgage Insurance Mortgage Payment Mortgage Companies

Inheritance Tax Here S Who Pays And In Which States Bankrate

South Carolina Sales Tax Small Business Guide Truic

State Taxes On Inherited Wealth Center On Budget And Policy Priorities